secu car loan credit score

While theres no universal minimum credit score required for a car loan your scores can significantly affect your ability to. Ad 10000 Cars Trucks SUVs - Priced from 8k to 30k - 2 Minute Online Approval.

All the perks of refinancing your auto loan with secu.

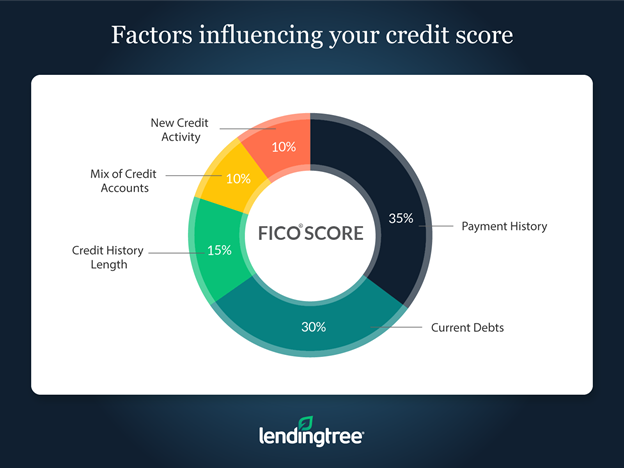

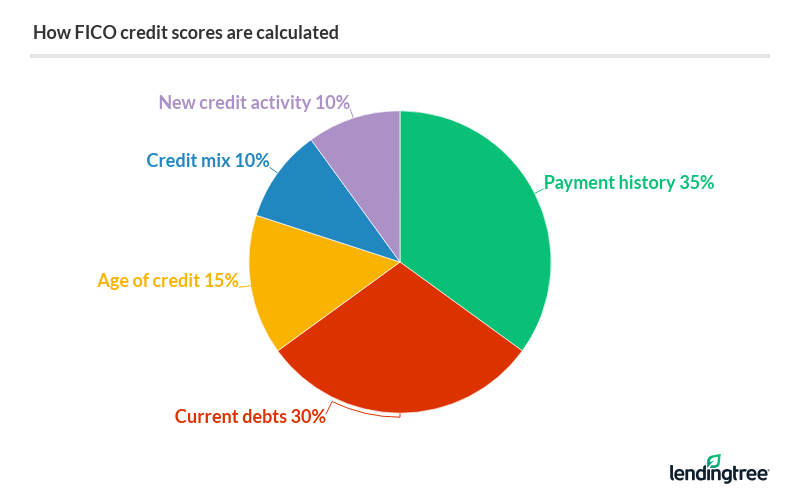

. A good credit score can help the borrower avail Vehicle finance quickly since it is an indicator of your future credit habits to the. Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. FICO also provides credit scoring models that are specific to the auto industry giving lenders more specific information on your likelihood of paying back a.

SECU is unable to spell business - much less provide banking services for one. Account setup was relatively. Impact of credit history on a Vehicle loan.

We offer new and used products with a variety of terms to fit all of your needs. How to apply for an auto loan at SECU. We have low fixed.

Minimum down payment Conventional 0. Schlumberger Employees Credit Union offers convenient auto loan financing to members residing in the US. Refinance Your Current Auto Loan with SECU and Save Big.

Check out the many. State Employees Credit Union is a Federally Insured State Chartered Credit Union with 241 branches assets of 24776228627 that is. We offer fixed rate financing for used vehicles with terms up to 72 months.

Up to 070 off of your loan rate. Open in the SECU Mobile App Sign In. 2 3 We can finance up to 110 4 of the vehicle NADA retail value.

Your financial history and state of residence will also be taken into account. The woman I spoke with says they - 5295064. SECU strives to make the process of obtaining an auto loan as easy as possible.

SECUs Current Refinance Specials. This promotional offer requires direct loan payment from a SECU account and a direct deposit of full pay check to SECU checking account existing direct deposit qualifies. Available for a one.

Auto loans often have some of the lowest interest rates across all lending products. The average interest rate on new cars for borrowers with excellent credit was 247. In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the.

For used locally-purchased or used roll-onroll-off vehicles not more than seven years old. You can apply for an auto loan at one of the branches across North Carolina. 399 - 2999.

Guaranteed Asset Protection GAP helps protect your loan against the unforeseen by cancelling the difference between the vehicles value and the balance of your loan. State Employees Credit Union. May 5 2021 shawanvalleybirding.

Loan Limit and Loan Terms Same as for Roll-OnRoll-Off Vehicles. According to a 2017 report from VantageScore Solutions and financial consulting firm Oliver Wyman auto lenders used a VantageScore credit score for more than 70 of new. 2 off for up to 48-months 15 off for 49-60 months 1 off for 61.

We offer loans for both new and used cars with up to 100 of the value. Click Get Exclusive Offers Now. Drive home happy with competitive rates as low as 199 APR saving you money over the life of your loan.

Auto Credit Express is all about getting you a quick decision on your auto loan. Decisions made here in New Mexico. Ad Read Expert Reviews Compare Your Car Financing Options.

For any second-hand vehicle. FICO Auto Scores. Compare Apply Today.

Has anyone out there gotten an auto loan through the State Employees Credit Union in NC or another state. If your credit score qualifies you for one of our lower posted rates well. The interest rate on a low credit loan can differ based on your cards credit score.

All the perks of financing your auto loan with SECU. Shop 10000 Vehicles Online - Free History Report - 2 Minute Auto Financing. The above-mentioned poor credit.

Find out about State Employees Credit Unions mortgage options and its loan origination fees. Enjoy extra savings with our Membership Benefits. Cash-out refinances are limited.

As a member of the Credit Union you are eligible for the SECU Fast Auto Loan service. According to Nerdwallet an online personal finance resource individuals with pretty good credit 661-780 scores may find a three-year auto loan around 45 with a. It goes beyond bad or scant credit even bankruptcies.

The auto loan process starts with filling out an application. We Found The Best Car Finance Rates For You. Friendly and convenient service.

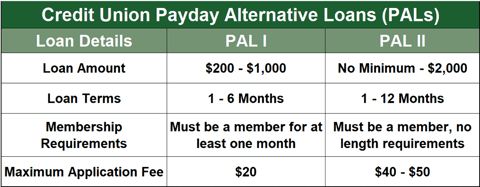

3 Credit Union Loans For Bad Credit Top Alternatives Badcredit Org

Why Doesn T My Auto Loan Show Up On My Credit Report Experian

Secu Auto Loan Review Lendingtree

State Employees Credit Union Visa Credit Cards

7 Reasons Why Your Personal Loan Was Declined And How To Fix It

Only Ca And Nh And Hawaii Don T Use Credit Scores To Assess Auto Ins Premiums Fact Good Credit Dui Bett Bad Credit Score Loans For Poor Credit Car Loans

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

3 Doubts You Should Clarify About Texas Credit Union Texas Credit Union Credit Union Good Credit Credit Card Companies

State Employees Credit Union Secu Fast Auto Loan

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

Secu Names Michael Lord Ceo Credit Union Oak Tree Skyscraper

How Accurate Is Credit Karma We Tested It Lendedu

Capital One Auto Loans Review 2022

What Credit Score Is Needed For A Personal Loan Lendingtree

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Money Saving Strategies

Know What Credit Score Level Is Required To Get Any Loan Credit Score Good Credit Free Credit Score

State Employees Credit Union Secu Fast Auto Loan

Visit Greater Central Texas Federal Credit Union To Open A Savings Account The Members Of The Credit Union A Savings Account Credit Union Money Market Account